Summary

You can add or update your tax information from within the Manage screen for your subscription.

Tax information is held per subscription, so it can be different for each license, and updating one license will not affect any others, even if they use the same information. This also means that you cannot add tax information to a license that has no subscription.

Steps To Add or Update Tax Information

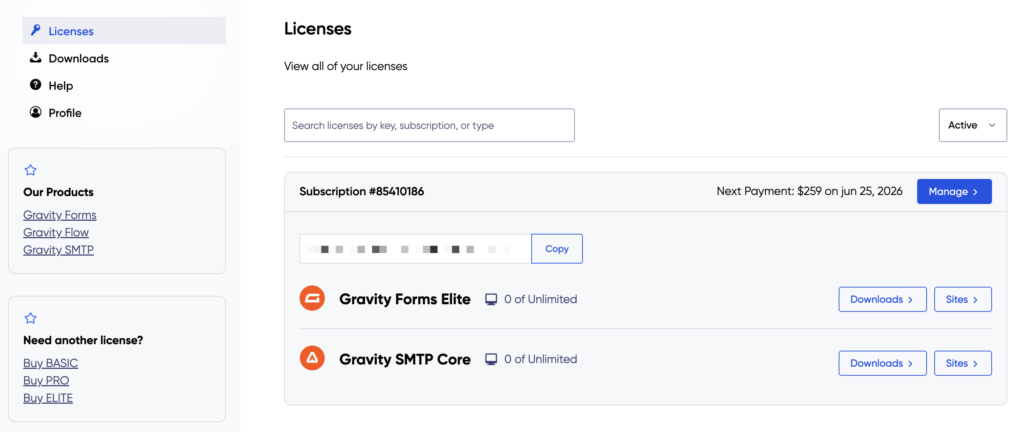

- Log into your Gravity account and go to the Licenses area.

- Click the Manage button for the subscription/license you wish to edit.

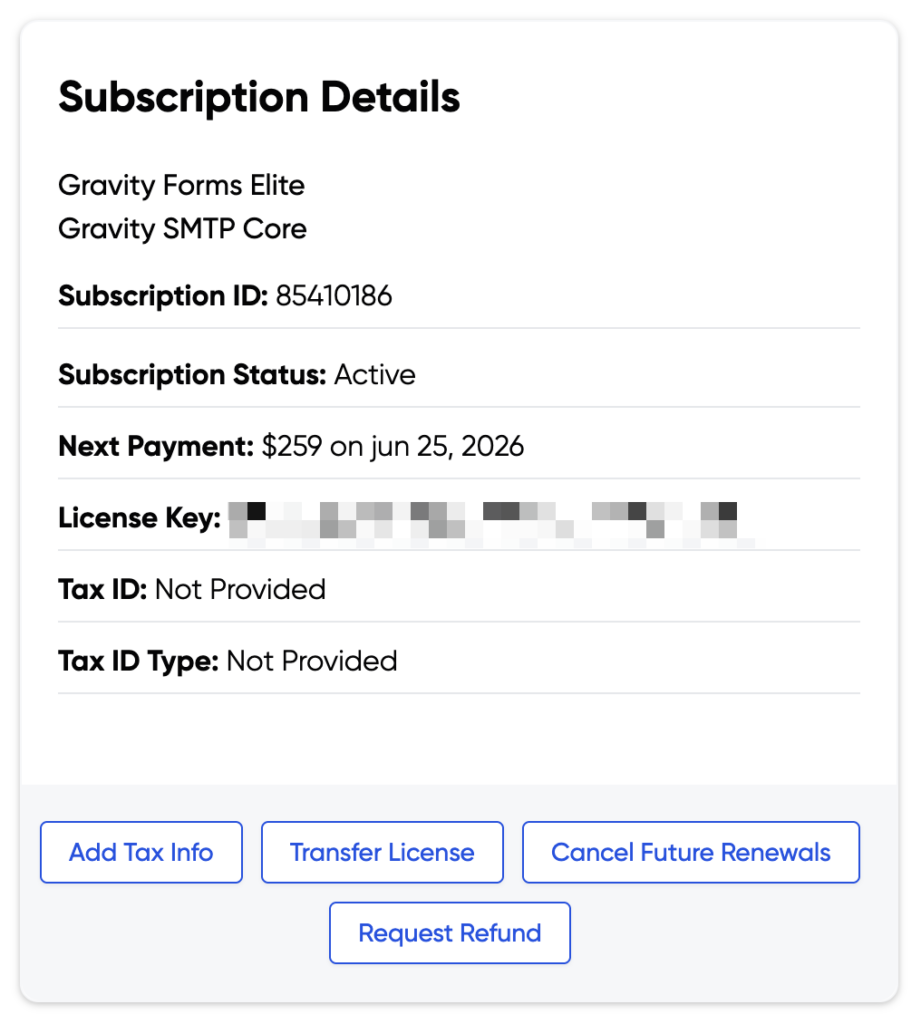

- At the bottom of the Subscription Details box on the next page, you will see an Add Tax Info button. Click the button.

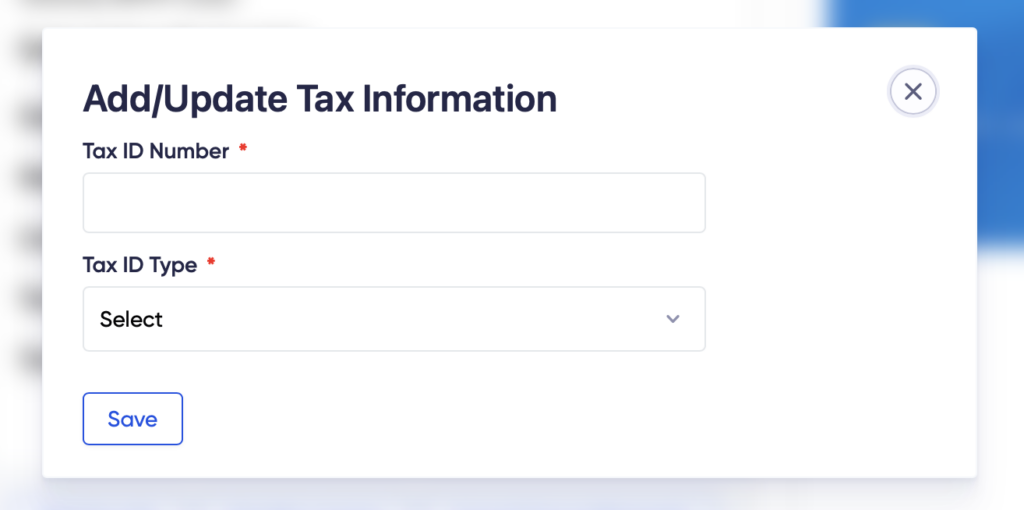

- This will present a dialog that allows you to enter information on your tax type and tax number.

- Click Save once you are done editing.

Steps To Delete

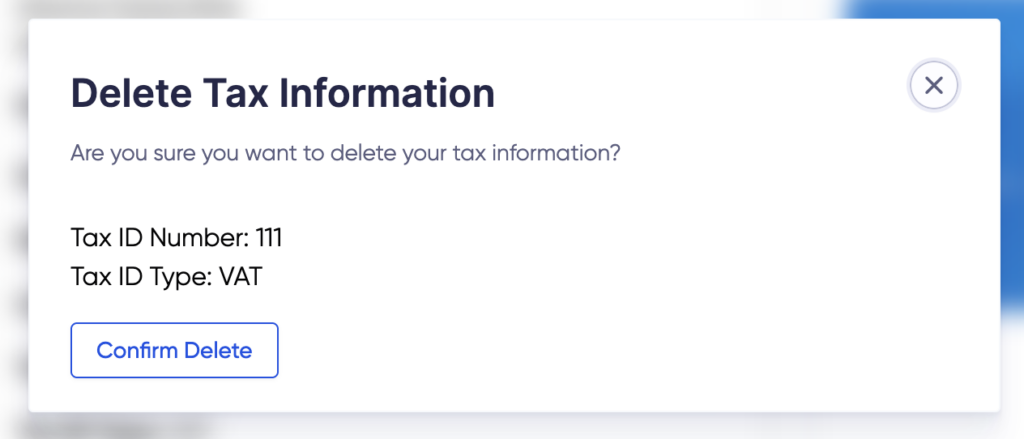

Once tax information has been saved for a subscription, you’ll see a new button, Delete Tax Info, at the bottom of the Subscription Details box. Click the button. This will present a dialog that allows you to confirm deletion.

Where do I see this information?

Your tax information is displayed on your receipts. Any receipt generated for that subscription renewal will show the tax information you have added.

You can also edit the tax information on a previous receipt temporarily (just for the purpose of modifying it when printing or saving). See this article for instructions on that process. This will not modify the tax information attached to the subscription.

If you transfer a license to another party, all subscription information is removed from that license, which also removes all tax information.