Summary

You can add or update your tax information from within your Manage Subscription screen.

Tax information is held per subscription, so it can be different for each license, and updating one license will not affect any others, even if they use the same information. This also means that you cannot add tax information to a license that has no subscription.

Steps To Add or Update Tax Information

- Log into your Gravity Forms account and go to Licenses & Downloads area.

- Click the Manage Subscription button for the license you wish to edit.

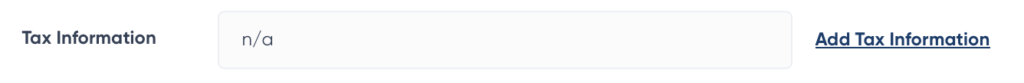

- On the details page, you will see a Tax Information field, click the Add or Update text button to the right.

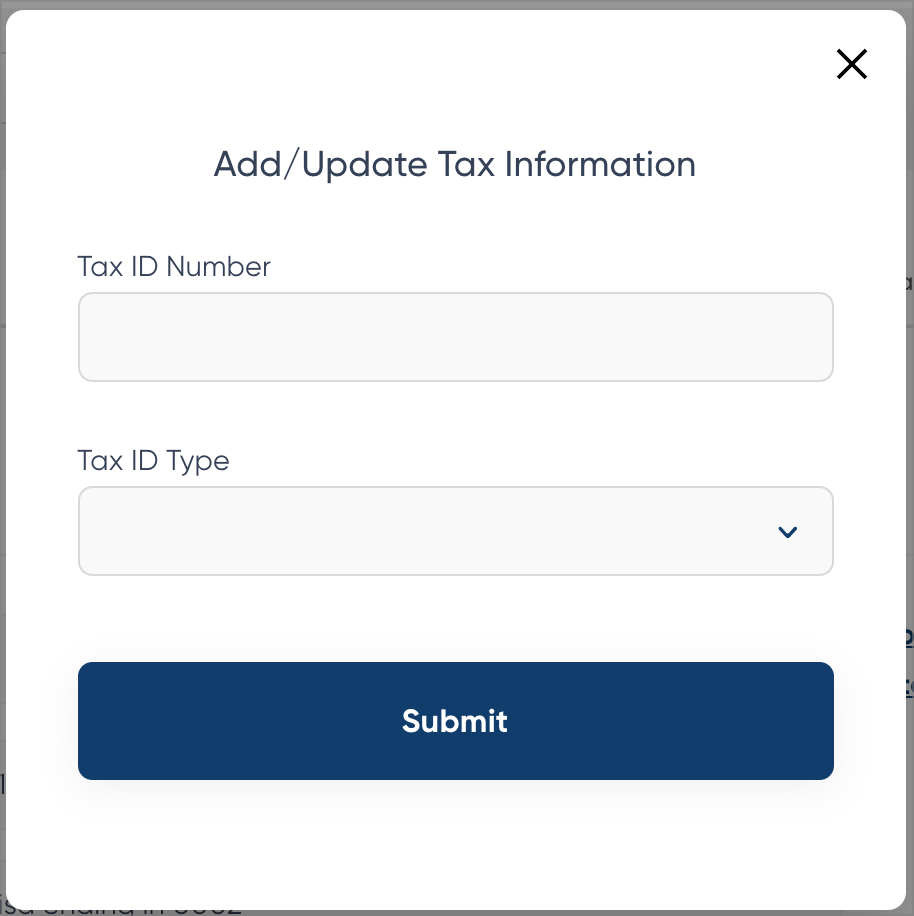

- This will present a dialog that allows you to enter information on your tax type and tax number.

- Click Save once you are done editing.

Steps To Delete

- Follow steps 1 and 2 above.

- Within the Manage Manage Subscription page, click the Delete button to the right of the tax field.

- This will present a dialog that allows you to confirm deletion.

Where do I see this information?

Your tax information is displayed on your receipts. Any receipt generated for that subscription renewal will show the tax information you have added.

You can also edit the tax information on a previous receipt temporarily (just for the purpose of modifying it when re-printing). See this article for instructions on that process. This will not modify the tax information attached to the subscription.

If you transfer a license to another party, all subscription information is removed from that license, which also removes all tax information.